Buying a Business? The Real Risk Isn't in the Purchase Price. It's in What You Don't Know Before You Sign.

Discover how smart buyers across New Zealand protect themselves with professional due diligence that uncovers hidden risks, validates the numbers, and gives them the confidence to negotiate (or walk away) before it's too late.

160+ 5 Star Google Reviews

Award Winning Firm

Trusted by Hundreds Of NZ Businesses

The problem every business buyer faces

Here's what most buyers don't realise until it's too late:

You're about to risk everything. Your savings, maybe even your family home, on a business decision that could change your life.

But the vendor's financials look great (of course they do). The handover sounds smooth (they always say that). And everything feels right (because you're already emotionally invested).

- Key customers tied to the current owner, not the business

- Margins that don't stack up

- Supplier relationships that won't transfer, or costs the vendor "forgot" to mention

- Seasonal cash flow gaps that leave you scrambling to make payroll in month three

- Hidden reinvestment costs, Equipment that needs replacing, leases that need renegotiating, staff that won't stay

- Overly optimistic projections That have no basis in the actual trading history

The real cost isn't just a bad investment. It's your financial security, your family's future, and years of your life trying to fix something that was broken before you bought it.

Here’s how the right due diligence saved these clients hundreds of thousands of dollars, time and headaches.

What makes our due diligence different

Most accountants and business consultants will run the numbers and hand you a report. We go deeper.

Independent and objective assessment

We work for YOU, to uncover what matters and raise the questions others won't ask.

Financial rigor meets real-world context

We combine sharp financial analysis with real-world business thinking. It's not just "numbers on a page". We explain what they mean and why they matter for YOU as the new owner.

Comprehensive risk and opportunity analysis

We highlight both the red flags AND the upsides. You'll understand where the business stands today and what that means when you take over tomorrow.

Structured, easy-to-follow reports

Our reports take you from data, to insight, to implication. Clear, objective, actionable. Designed for decision-making, not just filing away.

Follow-up support included

After you receive the report, we debrief the findings, answer your questions, and discuss any additional matters that arise. You're not alone in this.

Our Comprehensive Analysis Covers the Questions That Matter

1. Sales and customers

Who are the key customers? How concentrated is the revenue? Are sales growing, stable, or declining? Are there seasonal peaks or troughs that will impact your cash flow?

2. Purchases and suppliers

Who are the main suppliers? How dependent is the business on them? What happens if relationships don't transfer? Are margins sustainable under new ownership?

3. Gross profit analysis

Deep dive into margin performance (both $ and %). We analyse volatility, trends, and whether the gross profit you're seeing is sustainable going forward.

4. Overheads and fixed costs

Review of cost structure, spending trends, and whether expenses are under control or likely to increase. What costs are tied to the current owner?

5. Fixed assets assessment

If plant or equipment is included, we assess condition, ownership, sufficiency, and what reinvestment may be needed in the short to medium term.

6. Breakeven analysis

Evaluation of current breakeven position with commentary on how that may shift under new ownership (especially if you're drawing a salary vs. the current owner).

7. Transition and handover risks

Lease terms, staffing arrangements, intellectual property, systems documentation, and the real level of vendor support you can expect.

8. Catch-all review

We highlight any additional items identified during our work that present a risk, opportunity, or require further consideration before settlement.

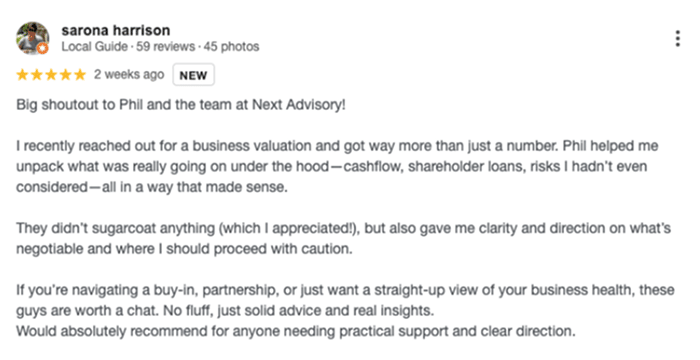

Real Stories from Real Buyers

Things to know

500,000+ Baby Boomer-owned businesses are hitting retirement age.

70% of them are profitable. Most of them have been quietly making money for years.

Most of them have NO succession plan, limited documentation, and owners who are ready to exit.

This creates massive opportunity for savvy buyers but also massive risk for unprepared ones.

Before you fall in love with another opportunity, let's make sure you're set up for success.

Book a 30-minute strategy call with Phil to discuss:

- The business you're considering (or the type of business you're looking for)

- Key questions you need answered before you commit

- How due diligence protects you and strengthens your negotiating position

- Whether this opportunity is worth pursuing or if you should keep look

This call is obligation-free. No pressure, no sales pitch. Just honest, expert guidance.